A luxury watch like a Rolex, Audemars Piguet, or Patek Philippe is a big investment. Many of these watches cost anywhere from £5,000 to £50,000. Some can even cost over $100,000. With these pieces valued as much as a car or a home, there’s no reason you shouldn’t insure them in the same way. However, it can be difficult to know where to start when it comes to insuring your luxury watch. Not everyone will have the same insurance needs, so it’s important to learn the basics and consider your options carefully. In today’s BQ Watches blog, we’ll give you some advice for properly insuring your luxury timepieces.

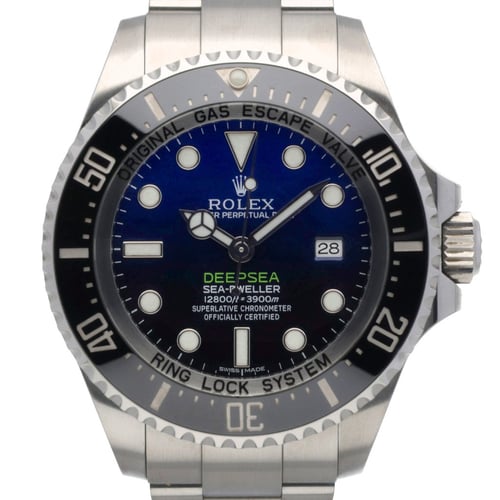

The first step is to assess your need for insurance and look at the value of your watch. When you’re assessing your need for insurance, there are numerous factors to consider. For instance, if you’re insuring a watch you wear every day, you may want to increase your cover compared to a watch that usually sits in its case. You may also want additional cover for sporting watches if you use them for things like diving, as they inherently have more risk of being lost or damaged.

You’ll also want to consider the size of your collection. If you have multiple luxury watches, it’s probably a better idea to get a plan that covers all of them. In the end, it comes down to how much risk you subject your watches to and the overall value of each timepiece. This will help you determine the level of cover you need.

While a watch appraisal may not be necessary for all insurance policies, it’s not a bad idea to get an idea of how appraisers would value your timepiece. If you have multiple collections, it’s a good practice to have an approximate estimate of your collection’s total value.

When you know how much your watch or watches are worth, it can make shopping for insurance easier, because you’ll know exactly how much cover you’ll need.

One common consideration is to look at your home or tenant insurance policy to see if your luxury watch would be covered. In some cases, these policies may provide enough cover for an entry-level luxury watch.

Generally, watches that are worth £1,500 or less would probably be fine under these policies. However, every policy will differ, so it’s important to read the fine print to make sure the value of your watch is covered. Also, you’ll want to look at the stipulations of your cover. Your insurance might just cover your watch being stolen from your home or damaged in a home accident like a fire. If you’re wanting cover outside of your home, you may need to look into other types of insurance policies.

If your home or tenant insurance policy isn’t enough to cover your watch or watch collection, you may want to discuss a personal possessions policy with your insurance provider. These policies can often be added to an existing policy, and they cover items that are more valuable than a typical policy would cover.

Jewellery and watches are common for personal possessions policies. The benefit of this is you don’t have to seek a new insurance company; you can simply add it to your existing insurance payment. With that being said, the terms of additional cover are sometimes limited, and there may be exclusions that aren’t ideal for luxury watches.

For most luxury watches, the best option is using a specialty insurer specifically focused on luxury watch insurance. If your collection is particularly valuable or large, this will provide you with the most secure insurance.

This insurance guarantees cover if your luxury watch is lost or stolen, providing you with peace of mind for your treasured timepieces.

Another common option is self-insurance. The way this works is pretty simple. Instead of paying an insurance company every month or on a yearly basis, you simply set aside money in a separate account that you can use if something happens to your watch.

Obviously, self-insurance will require you to build up enough capital in that account to cover something in case of an accident, so this option isn’t necessarily ideal for everyone.

Although insuring a luxury watch is undoubtedly important, it’s not the exciting part of owning and purchasing a watch. For that, there’s BQ Watches. We have a full inventory of the best luxury watch brands in the industry. At BQ Watches, you can find Rolex, Audemars Piguet, Patek Philippe, IWC, Bremont, Breitling, Panerai, Omega, Tudor, and many others. We also offer comprehensive sourcing services if you have a specific watch in mind that you don’t see in our inventory. And if you’re needing an appraisal to send to your insurance company, we can provide a professional appraisal for you as well.

Here at BQ Watches, we always make sure you have an enjoyable watch-buying experience, whether you’re buying from our online store or in person at our London showroom. When you shop with BQ Watches, you’ll easily find a watch that is well worth insuring. Browse our inventory to find your next luxury timepiece today!